Wall Street's Crystal Ball: Nasdaq Chief Predicts Blockbuster IPO Season Ahead

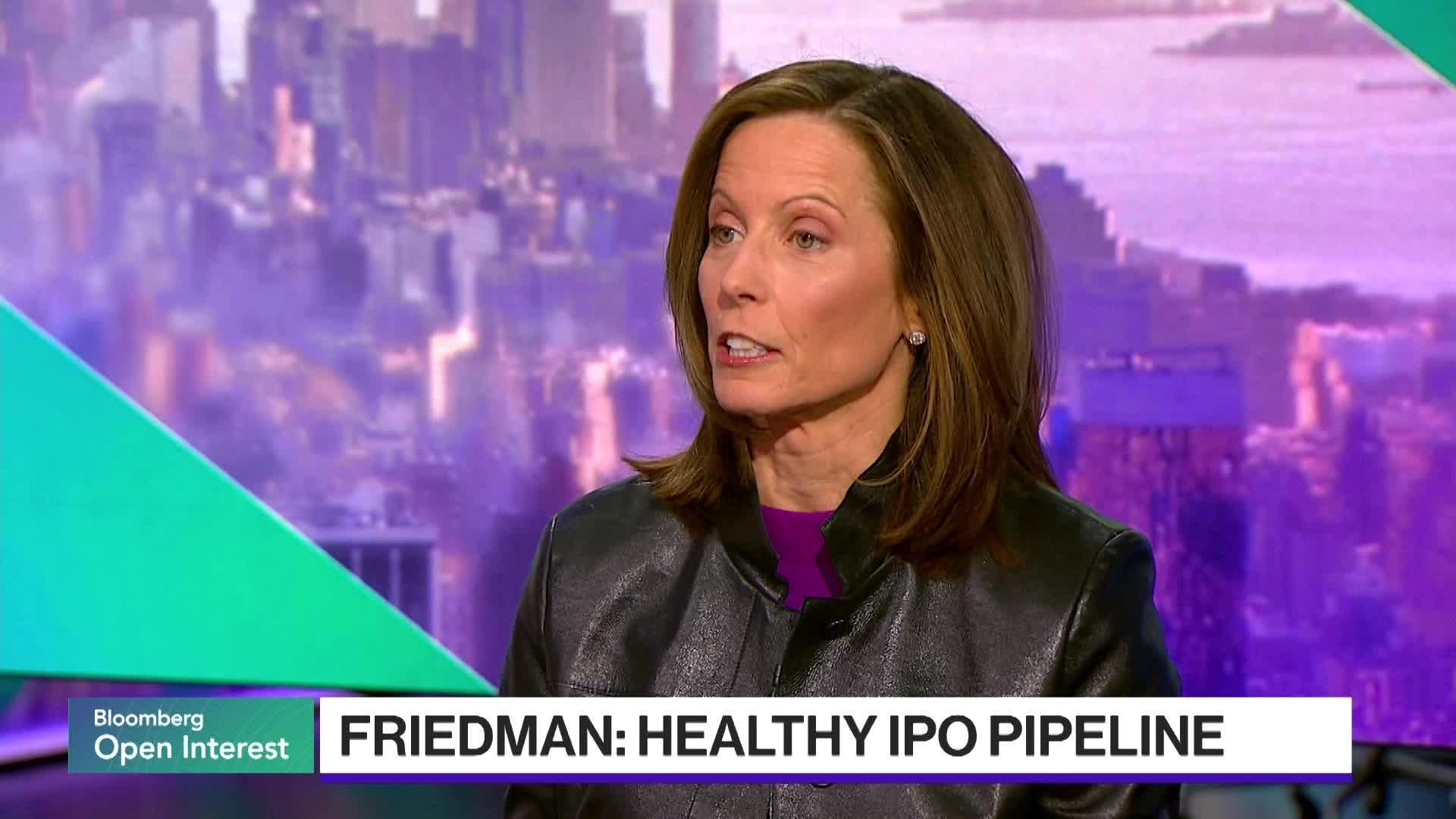

In a compelling interview on Bloomberg Open Interest, Nasdaq Chair and CEO Adena Friedman offered profound insights into the evolving landscape of financial markets, emerging technologies, and regulatory challenges. Friedman delved into critical topics including the current state of initial public offerings (IPOs), the transformative potential of artificial intelligence, and the urgent need for modernized regulatory frameworks in the United States.

With her characteristic strategic vision, Friedman highlighted the dynamic shifts occurring in the IPO market, emphasizing how technological innovations and investor sentiment are reshaping traditional market entry strategies. Her commentary underscored Nasdaq's pivotal role in navigating these complex market transitions.

The discussion also explored the groundbreaking implications of artificial intelligence, with Friedman providing nuanced perspectives on how this technology is poised to revolutionize multiple sectors. She stressed the importance of responsible AI development and the critical need for adaptive regulatory approaches that can keep pace with rapid technological advancements.

Friedman's insights reflect her leadership at Nasdaq, where she continues to champion innovation, market transparency, and forward-thinking regulatory strategies that balance technological progress with investor protection.